what is the tax rate in tulsa ok

This rate includes any state county city and local sales taxes. Inside the City limits.

5 Things You Should Know About Oklahoma Taxes Oklahoma Policy Institute

Inside the City limits of Tulsa the Sales tax and Use tax is.

. 2020 rates included for use while preparing your income tax deduction. This is the total of state and county sales tax rates. Online You will need.

The latest sales tax rate for Tulsa OK. How much is tax by the dollar in Tulsa Oklahoma. This is the total of state county and city sales tax rates.

The median property tax also known as real estate tax in Tulsa County is 134400 per year based on a median home value of 12620000 and a median effective property tax rate of. 2020 rates included for use while preparing your income tax deduction. The Oklahoma state sales tax rate is currently 45.

Tulsa County - 0367. How much is tax by the dollar in Tulsa Oklahoma. The Tulsa Oklahoma sales tax is 450 the same as the Oklahoma state sales tax.

Ad Compare Your 2022 Tax Bracket vs. The 2022 state personal income tax brackets. The Tulsa Oklahoma sales tax is 852 consisting of 450 Oklahoma state sales tax and 402 Tulsa local sales taxesThe local sales tax consists of a 037 county sales tax and a 365.

Whether you are already a resident or just considering moving to Tulsa to live or invest in real estate estimate local property tax rates and learn how. The latest sales tax rate for Tulsa County OK. What is the sales tax rate in Tulsa OK.

The median property tax in Tulsa County Oklahoma is 1344 per year for a home worth the median value of 126200. While Oklahoma law allows municipalities to collect a local option sales tax of up to 2 Tulsa does. Oklahoma has a 45 sales tax and Tulsa County collects an additional.

What is the sales tax rate in Claremore OK. Learn all about Tulsa real estate tax. What is the sales tax rate in New Tulsa Oklahoma.

City 365. State of Oklahoma - 45. The latest sales tax rates for cities in Oklahoma OK state.

Your 2021 Tax Bracket to See Whats Been Adjusted. 2020 rates included for use while preparing your income tax deduction. Tulsa County collects on average 106 of a propertys assessed.

Before the official 2022 Oklahoma income tax rates are released provisional 2022 tax rates are based on Oklahomas 2021 income tax brackets. The minimum combined 2022 sales tax rate for Tulsa County Oklahoma is 852. The minimum combined 2022 sales tax rate for New Tulsa Oklahoma is.

This rate includes any state county city and local sales taxes. 2483 lower than the maximum sales tax in OK. Rates include state county and city taxes.

However left to the county are evaluating property mailing billings taking in the levies engaging in. While maintaining constitutional limitations mandated by law the city sets tax rates. Does Tulsa have income tax.

Tulsa County 0367. Discover Helpful Information and Resources on Taxes From AARP. State of Oklahoma 45.

The current total local sales tax rate in Oklahoma City OK is 8625. The 8517 sales tax rate in Tulsa consists of 45 Oklahoma state sales tax 0367 Tulsa County sales tax and 365 Tulsa tax. The total sales tax rate in any given location can be broken down into state county city and special district rates.

By mail Make checks payable to the City of Tulsa and mail to the City of Tulsa Lodging Tax Processing Center 8839 North Cedar Avenue 212 Fresno CA 93720. Inside the City limits of Tulsa the Sales tax and Use tax is 8517 which is allocated between three taxing jurisdictions. The total sales tax rate charged within.

For the 2020 tax year Oklahomas top income tax rate is 5.

Pin On Emily S Senior Pics Ideas

From The Ashes Biological Parents The Neighbourhood Outdoor Decor

Rates And Codes For Sales Use And Lodging Tax Oklahoma Tax

Rates And Codes For Sales Use And Lodging Tax Oklahoma Tax

The Best Places To Own A Home And Pay Less In Taxes The Good Place Estate Tax Tax

Rates And Codes For Sales Use And Lodging Tax Oklahoma Tax

Oklahoma Sales Tax Small Business Guide Truic

Hitch It Trailer Sales Trailer Parts Service Truck Accessories Trailers For Sale Lake Fun Aqua Lily Pad

Individual Income Tax Oklahoma Policy Institute

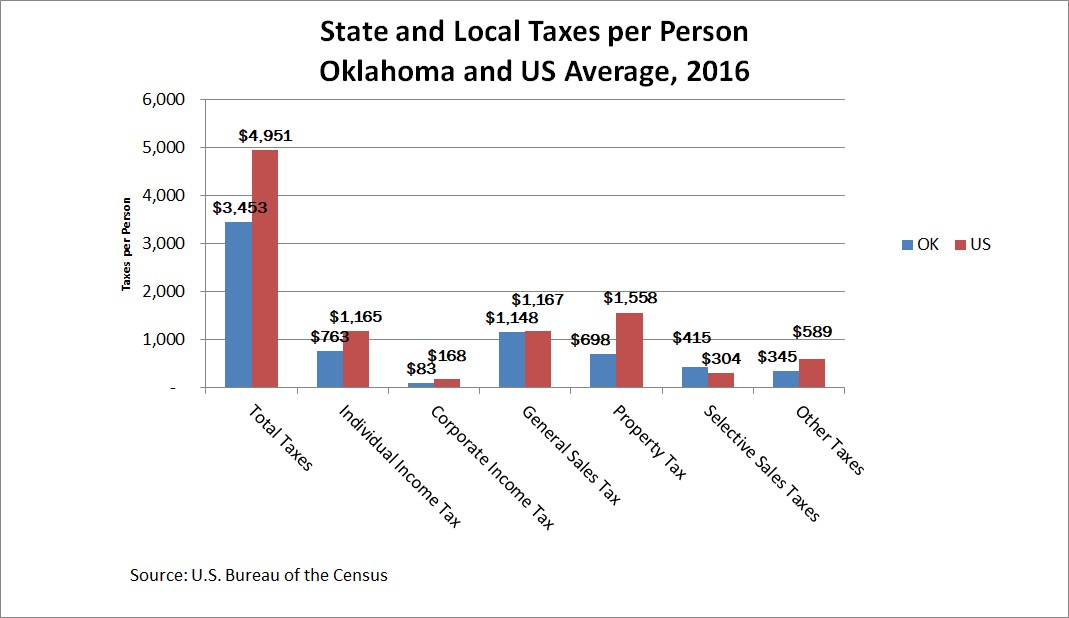

How Oklahoma Taxes Compare Oklahoma Policy Institute

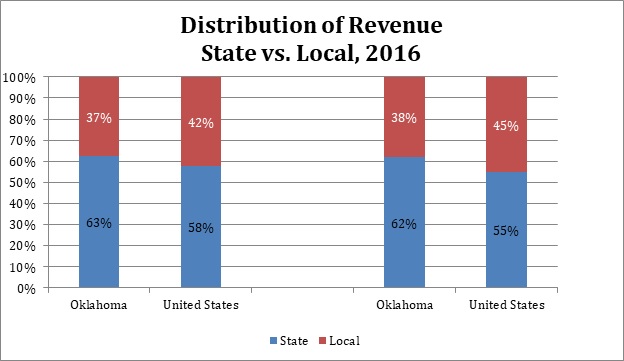

State And Local Tax Distribution Oklahoma Policy Institute

Irs Installment Agreement Chicago Il 60647 Mm Financial Consulting Inc Chicago Internal Revenue Service Lettering

Hitch It Trailer Sales Trailer Parts Service Truck Accessories Trailers For Sale Truck Accessories Enclosed Trailers

Can I Have My Federal Student Loans Discharged If I Declare Bankruptcy In Tulsa Oklahoma Debt Management Plan Debt Relief Debt Relief Programs

Total Sales Tax Per Dollar By City Oklahoma Watch

Good To Know For Your Tax Earnings Reference For The 2019 Calendar Year As You Accumulate Income Now Accounting Taxe Tax Brackets Income Yearly Calendar